How Livestock Threat Protection (LRP) Insurance Policy Can Secure Your Livestock Financial Investment

In the realm of animals financial investments, mitigating risks is vital to guaranteeing monetary security and growth. Livestock Threat Protection (LRP) insurance coverage stands as a trustworthy shield against the uncertain nature of the market, supplying a critical strategy to guarding your properties. By diving into the complexities of LRP insurance and its multifaceted advantages, livestock producers can strengthen their financial investments with a layer of security that goes beyond market fluctuations. As we explore the realm of LRP insurance policy, its duty in safeguarding animals investments becomes progressively evident, assuring a course in the direction of lasting economic strength in an unpredictable sector.

Comprehending Livestock Threat Security (LRP) Insurance

Recognizing Livestock Threat Security (LRP) Insurance is necessary for livestock manufacturers wanting to mitigate monetary risks connected with price changes. LRP is a federally subsidized insurance coverage item developed to shield producers versus a drop in market value. By supplying coverage for market value declines, LRP aids producers lock in a flooring price for their animals, making certain a minimum degree of revenue regardless of market variations.

One key element of LRP is its flexibility, enabling manufacturers to tailor coverage degrees and plan lengths to fit their details needs. Producers can pick the variety of head, weight array, coverage cost, and insurance coverage duration that align with their manufacturing objectives and take the chance of resistance. Understanding these adjustable choices is crucial for producers to efficiently handle their cost threat direct exposure.

Furthermore, LRP is offered for numerous animals kinds, including cattle, swine, and lamb, making it a versatile danger administration device for livestock manufacturers across various markets. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, manufacturers can make informed choices to guard their investments and ensure financial stability in the face of market unpredictabilities

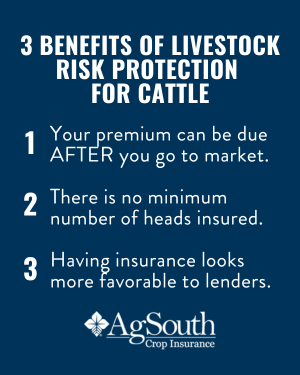

Advantages of LRP Insurance for Animals Producers

Livestock manufacturers leveraging Animals Danger Protection (LRP) Insurance policy get a calculated advantage in securing their financial investments from price volatility and protecting a secure monetary footing in the middle of market uncertainties. By establishing a floor on the rate of their livestock, manufacturers can reduce the threat of considerable financial losses in the occasion of market downturns.

Additionally, LRP Insurance policy gives manufacturers with peace of mind. In general, the benefits of LRP Insurance policy for livestock manufacturers are substantial, providing a useful device for taking care of danger and guaranteeing financial safety and security in an unpredictable market environment.

Just How LRP Insurance Policy Mitigates Market Dangers

Minimizing market dangers, Livestock Threat Security (LRP) Insurance gives livestock manufacturers with a reliable guard against cost volatility and financial unpredictabilities. By providing defense against unexpected cost drops, LRP Insurance policy assists manufacturers safeguard their investments and keep financial stability in the face of market changes. This kind of insurance permits livestock producers to secure in a price for their animals at the start of the plan period, making certain a minimum cost degree no matter market adjustments.

Actions to Safeguard Your Livestock Financial Investment With LRP

In the world of agricultural threat management, executing Animals Risk Defense (LRP) Insurance includes a strategic process to safeguard financial investments against market fluctuations and uncertainties. To protect your animals investment properly with LRP, the initial action is to assess the particular dangers your procedure encounters, such as price volatility or unanticipated weather events. Comprehending these dangers enables you to establish the protection degree needed see this site to secure your financial investment effectively. Next, it is essential to study and choose a reputable insurance policy provider that offers LRP policies customized to your livestock and business demands. As soon as you have chosen a provider, carefully assess the plan terms, conditions, and insurance coverage limits to guarantee they align with your danger management goals. Furthermore, frequently keeping an eye on market fads and changing your coverage as required can help maximize your security versus possible losses. By complying with these steps diligently, you can enhance the security of your animals investment and navigate market uncertainties with self-confidence.

Long-Term Financial Safety With LRP Insurance Coverage

Making sure withstanding monetary security with the usage of Livestock Threat Defense (LRP) Insurance coverage is a prudent long-term strategy for farming manufacturers. By including LRP Insurance policy right into their danger management plans, farmers can protect their livestock investments versus unanticipated market changes and unfavorable events that can threaten their monetary well-being over time.

One trick advantage of LRP Insurance policy for long-lasting financial security is the tranquility of mind it supplies. With a trustworthy insurance coverage in area, farmers can minimize read this article the monetary threats related to volatile market problems and unexpected losses because of elements such as condition outbreaks or all-natural disasters - Bagley Risk Management. This security allows manufacturers to concentrate on the daily operations of their animals business without continuous fear regarding possible financial obstacles

Furthermore, LRP Insurance policy provides an organized approach to handling risk over the lengthy term. By establishing certain insurance coverage levels and selecting proper recommendation periods, farmers can tailor their insurance intends to line up with their monetary objectives and risk investigate this site resistance, ensuring a safe and secure and sustainable future for their livestock operations. Finally, investing in LRP Insurance coverage is a positive approach for farming manufacturers to achieve lasting financial protection and safeguard their source of incomes.

Conclusion

In conclusion, Animals Danger Security (LRP) Insurance is a useful device for livestock manufacturers to alleviate market dangers and secure their investments. By understanding the benefits of LRP insurance policy and taking steps to execute it, producers can accomplish long-lasting economic protection for their operations. LRP insurance coverage gives a safety and security net against rate fluctuations and makes sure a degree of security in an uncertain market atmosphere. It is a sensible selection for guarding animals investments.